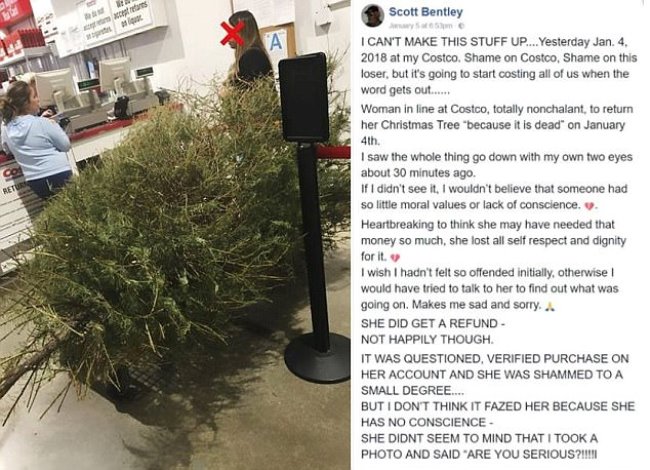

That story about a woman who returned a Christmas tree to Costco on Jan. 4 “because it [was] dead” – and got a full refund – sure got people talking.

Costco gave the woman a refund after questioning her, verifying the purchase on her account, and shaming her “to a small degree,” Fortune reported. This seems to me a little bit like getting a refund on the dozen roses you gave your wife for Valentine’s Day on, say, Feb. 28.

People who heard about the dead Christmas tree return vented on social media about how cheap some folks are.

Yet this type of behavior exists because companies allow some customers to take advantage of them.

Apparently Costco is famous for taking back almost anything at nearly any time. People have reportedly gotten refunds for dead plants, old mattresses, empty wine bottles, and personal photos.

Which leads me to wonder:

Why do some businesses allow these questionable refunds?

Big retailers with lenient return policies may just write this off as part of doing business. Sometimes the line between what constitutes a legitimate return, and a questionable one, is blurry (not so much with old roses and Christmas trees!). Companies may decide to eat the product cost and issue a refund to maintain goodwill with the customer.

We’ve also talked about this issue as it relates to businesses not getting paid on time, and steps CFOs and business owners can take to keep accounts receivables flowing smoothly. It’s very important on the income side of the ledger not let your customers delay paying you too long. If you allow too many customers or clients to stretch you out too far, it will begin to put a serious crimp in your cash flow.

On the other hand, we all want to keep our customers happy. And having the “where’s the money?” conversation is not usually comfortable for anyone.

This is a topic we cover in some detail in “The E-Myth Chief Financial Officer,” the new book I’m writing with Michael E. Gerber, author of the E-Myth series.

Here’s a preview with a few pointers:

Don’t make your sales or customer support people be the bad guys by asking them to collect money from your customers. You need someone to maintain that positive relationship that makes the customer feel good about doing business with you.

Realize your customers may be delaying payment because they are having financial problems of their own. And you will probably always have some clients who won’t pay or will delay paying you as long as they can.

This of course doesn’t relieve you of the need to collect overdue bills. It may get to the point where you decide you have to fire those customers – turn the matter over to collections and say we are not going to do business with them anymore.

How do you know when you have reached that point? Usually it’s obvious. The pain and time consumed doing business with the customer who constantly pays late outweighs the benefit of getting paid.

Have you experienced these issues running your business?

If so we’d love to hear your thoughts on how you dealt with them – and if you would accept a return on a “dead” Christmas tree in January!

Leave A Comment

You must be logged in to post a comment.